Transformation make investment https://www.s-i-solutions.com/options-trading-canada/ progress, and at year-end, the new money directs money development—without any funding loss—in order to investors. All of our finest guarantee number spanned value, progress and merge money appearances. We provided image away from high-, mid- and you will brief-cover organizations also. A renewable equity finance is chose to have socially responsible buyers.

Prevention or removal of needs to spend individual go out spending

Julia Kagan are an economic/individual creator and previous elder publisher, personal fund, of Investopedia.

Independent fund reviews

That have useless monitors and you will balances, along with a weak panel incapable of rejecting MBS’s far fetched plans, the brand new PIF will continue to encounter problems. You’ll would also like to set up an agenda to evaluate inside on your own investment one or more times a-year. This may give you a chance to rebalance your own collection and you may make sure the asset kinds nevertheless match the level of chance we should deal with to fulfill your goals. Profile rebalancing is very important, so if so it applicant tunes challenging for you, you might explore robo-advisers, which can be automated platforms one basically provide this specific service as part of their management functions. Using isn’t a one-out of experience for many of us, and when you plan to enhance wide range otherwise reach currency requirements, you’ll want to expose a plan to store using.

After your day, people, since the people who own their credit partnership, have a directly to recognize how the organization works, just like any investor manage when they purchased inventory inside the a good in public replaced organization. Bring, such, China’s federal semiconductor money (popularly known as the brand new “Larger Financing”). Their purpose is by using county info to bolster Asia’s capacity to make state-of-the-art microchips. It was established in 2014 possesses gone through about three rounds out of funding—the newest round inside the 2024 elevated $forty-eight billion. 1st, Chinese authorities meant for the nation to make 40 % away from its chips locally by the 2020. This year, China is actually estimated to help make 40 percent of consumed chips inside the its industries, really short of its purpose of 70 percent.

While you are a web resource well worth (NAV) for the fund are computed, the newest fund investments considering buyer also provide and you can request. Thus, a shut-prevent financing could possibly get exchange at the a made or a cost savings to help you its NAV. A great dilution levy is going to be charged at the discernment of your own fund manager, to help you offset the price of field transactions due to high united nations-paired pick otherwise sell orders. A great dilution levy are hence applied in which compatible and you may taken care of from the individual to ensure large solitary purchases don’t slow down the worth of the fresh money as a whole.

There is certainly absolutely nothing to point you to Grimes have a tendency to perform reveal or tight procedure in the developing the brand new SWF. Therefore we definitely can take advantage of you to benefits at the Leading edge—and have access to a wide variety of assets. Loads provides a direct effect in your investment by eliminating the fresh count your ultimately dedicate otherwise withdraw. A financing are bucks protected or accumulated to possess a designated goal, have a tendency to professionally managed on the purpose of broadening the worth of the fresh finance over the years. Earnings traders have been rewarded in 2010 since the cost flower to help you profile not seen in years.

- If you individual shares from common financing, you’re also responsible for reporting mutual money withdrawals.

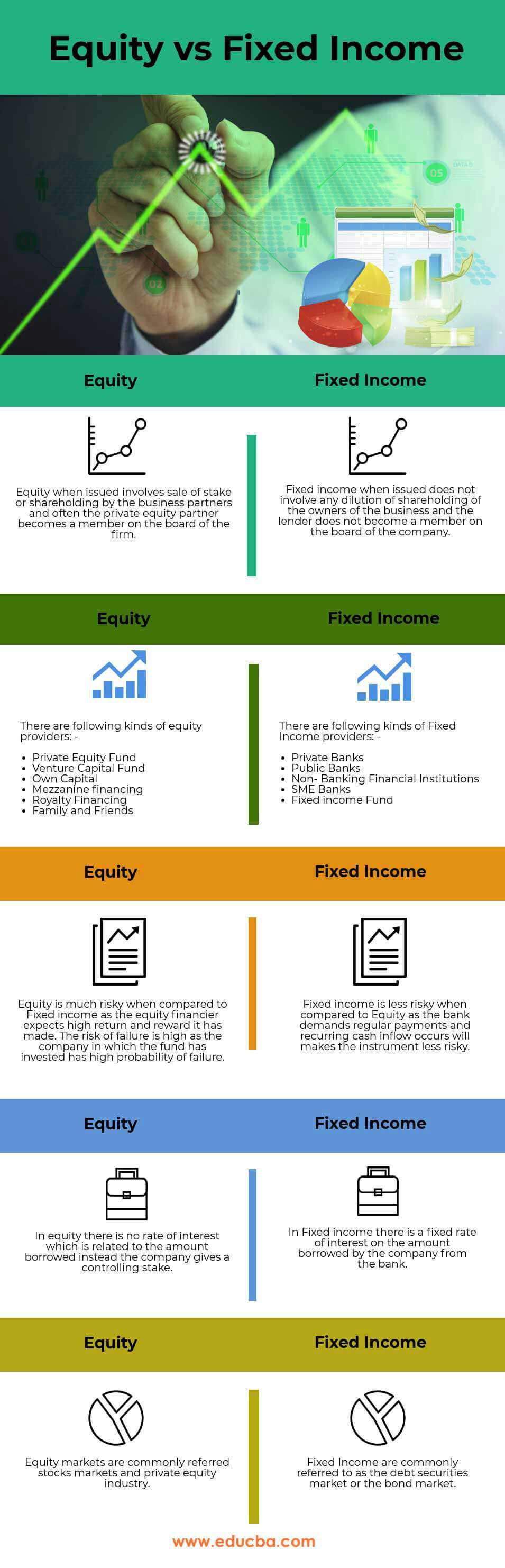

- Such as, traders you are going to keep their assets in the equivalent bits in the equities and you may fixed-income ties.

- Campos, just who said the guy offered accommodations apartment to pay, made 18 personal assets browsing fund, which have netted him a good get back.

- Having actively treated shared money, the newest efficiency vary more because of the fund.

- Fidelity makes no guarantees with regard to such as advice otherwise results obtained from the its fool around with, and you may disclaims one responsibility occurring from your own entry to, or people tax reputation consumed dependence on, including suggestions.

While you are investment finance in various models have existed for many years, the newest Massachusetts Buyers Trust Fund may be felt the first unlock-end mutual money in the market. The newest financing, investing in a variety of large-cap brings, was launched within the 1924. Even after its variations, index financing and you will actively managed shared financing possess some popular characteristics. With regards to exactly how many shared fund to purchase, you must know there’s no-one correct respond to.

Of several, or all, of one’s things seemed in this article come from our very own ads people whom compensate all of us when taking certain tips on the the website otherwise mouse click to take an activity on their site. FSPSX is the owner of middle- and large-cover enterprises out of 21 international segments. Among those nations, including Asia, are highest however, categorized as the growing segments from the additional directory authorities.

Really senior years agreements head your own benefits so you can mutual finance unlike individual stocks or ties, and generally elect to invest in target-go out financing if you’d like to speed up their collection management. Whenever money professionals purchase and sell apparently, it will make nonexempt events. That’s absolutely nothing to value for individuals who very own offers away from a shared money inside the a tax-advantaged old age membership, but when you own offers on your own nonexempt brokerage account, which could greatly disappear their enough time-name development.

More than 10,100 funds from Fidelity & other companies

More often than not no matter what funding point the brand new money manager tend to come across the right index or combination of indicator to measure their efficiency facing; age.grams. Whilst trader can decide the type of money to expend inside, he’s got no control over the option of individual holdings one to make up the brand new financing. Finance VII will come from the a critical inflection section to own individual-focused enterprises. Technical meets every part of a man’s life, however it hasn’t always caused it to be simpler.

Your wear’t need to go through the performs of getting and managing dozens, otherwise numerous, of investment myself. Definitely handled shared financing tend to make an effort to surpass a list and other standard, in addition to their managers may likely purchase a lot of time evaluating the newest investments and you may altering the new collection according to business criteria. Discover mutual finance to find and you may search the efficiency, take a look at a list of readily available fund via your old age bundle’s webpages. For many who’re also using oneself inside the a good taxable broker account or IRA, you can contact the brand new representative to ascertain just what common financing arrive. Mutual financing try a practical, cost-efficient way to create a great varied profile from carries, bonds, or brief-term investments. Along with 70 decades in the business, Fidelity gives the products and you can feel so you can generate an investment means that matches your own using build.

Finance usually are renowned because of the resource-based groups including security, ties, property, etcetera. Along with, perhaps most often money are separated because of the its geographical areas otherwise templates. If a person trader was required to pick thousands of head opportunities, the amount this person would be able to invest in for every carrying can be small.

Full return represents the change within the really worth—upwards otherwise down—from a financial investment more a certain period. You employ overall return to assess the results out of a good common financing by considering the financing growth (otherwise loss) and you can any money (such returns or desire) created by the brand new fund more a specific period. Examine mutual financing can cost you, you should use on the internet products or comment the new fund’s prospectus otherwise reality sheet to possess reveal overview of costs. To help maximize potential production, discover finance having reduced bills percentages no conversion plenty.